Decelerating Growth Expected in 2019

April 1, 2019

MHEDA dealers expect growth to continue in 2019, though not at the record pace of previous years

Each year in the 1st Quarter issue of The MHEDA Journal, we survey the industry to try to determine what can be expected from the economy in the coming year. To do this, we solicit forecasts from our partner associations like MHI (page 57), ITA (page 60) and CEMA (page 59). We also speak to MHEDA members from both the distributor and supplier sides of the industry. This year, we had the added benefit of being able to interview well-respected economist and presenter at this year’s MHEDA Convention, Brian Beaulieu. Taken together, these forecasts should provide some insight into where the industry is heading in 2019 and beyond.

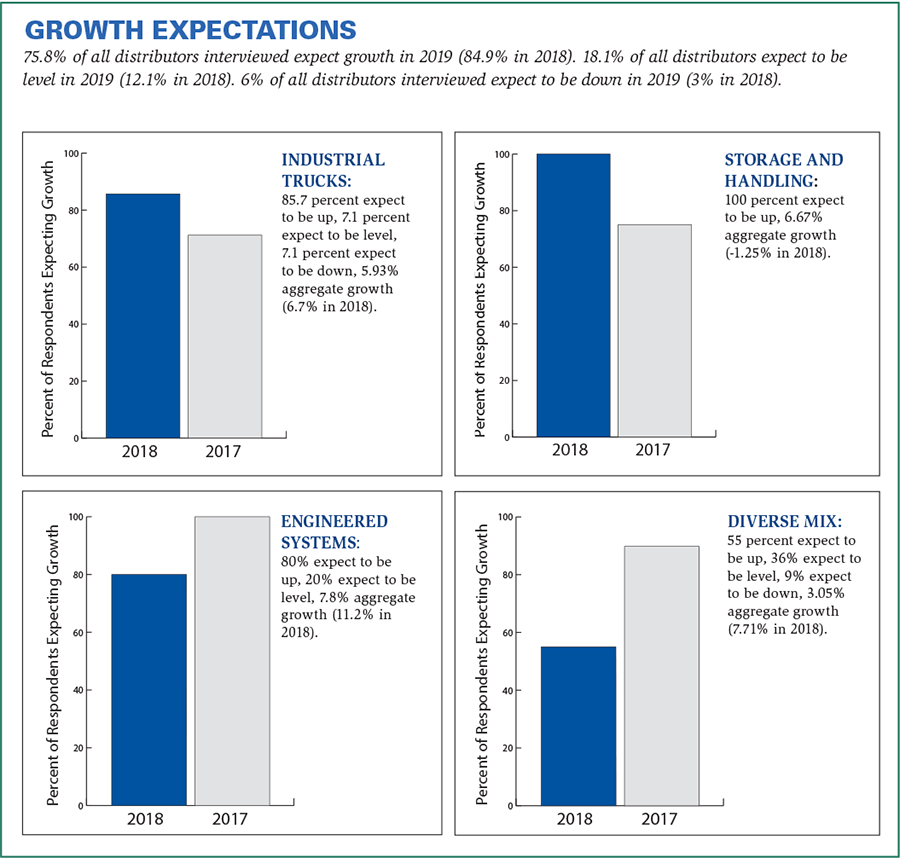

Last year, for the first time in seven years, there was not a unanimous expectation of growth across all industry segments, as Storage and Handling companies forecasted a net loss for 2018. For 2019, we have returned to all industry segments forecasting growth, as Storage and Handling projects to bounce back to 6.67% growth in 2019. And while no geographic regions of the country are expecting a loss, the west coast is expecting a relatively flat 2019, projecting just a 0.83% growth. The real economic driver of the U.S. appears to be the South, as the Southeast (8.92% growth projection) and Southwest (13% growth projection) easily outstrip the projections of the rest of the country.

As was the case two years ago, this forecast took place around an important election. For the first time in two years, we now have a split Congress, with Democrats retaking the House of Representatives while Republicans retained control of the Senate. This didn’t seem to dampen enthusiasm among respondents, who seemed to have baked in the prospect of Washington gridlock to their projections. The more pressing concern than any new legislation will be what effect, if any, continued tariffs will have and how the threat of inflation will impact prices in 2019.

The following are responses from MHEDA dealers across North America about what they expect to see in 2019. Respondents are grouped by region, but to see anticipated growth by segment of the industry, see the graph on page 42.

Northeast

In 2015, ’16 and ’17, the Northeast was the least optimistic region in the country, but in 2018 the Northeast unexpectedly came in as the mostoptimistic region, jumping from a 3.86% projection in 2017 to an 8.5% projection in 2018. This year, the Northeast settled somewhere in the middle with a projection of 5.13% growth, ahead of the West coast and Midwest but behind the Southeast and Southwest.

Mid Atlantic Industrial Equipment Ltd CFO/Principal David Lang forecasts a flat year in 2019. “I anticipate equipment being down, with growth in the aftermarket. Essentially flat overall,” he says. That echoes his comments in 2018, where aftermarket sales growth was the primary driver as well. In what will become a trend, Lang notes that tariffs and fuel prices unexpectedly rising could have a major negative impact on the economy. He says that inflation will force a need to increase pricing in 2019.

Market demand and prospect penetration will be the primary drivers of a projected 10% growth in 2019 according to Alliance Material Handling President and CEO Thomas Albero. This is a continuing trend that emerged in 2018 where the company’s systems/racking business grew significantly. Albero projects for the industry, as a whole, to see a 5-10% growth next year. Alliance will be prepared to handle the projected growth with existing staff, but does plan to add sales staff and technicians throughout the year. The company will also be making an investment in a new ERP system in 2019.

Thompson & Johnson Equipment Company expects to see 5-8% growth in 2019, according to President David Schneckenburger. He expects improved rental, equipment sales and service business to contribute to that growth. Thompson & Johnson will look to hire an internal sales coordinator in the first quarter of the year, while adding a sales rep in the second half of the year. As with most forklift companies, they are always on the lookout for service technicians as well. He notes, “The biggest concern will be the affect on business with the New York State Paid Leave Act and the potential of adding Bereavement to the program.”

Wecon Systems VP of Operations Will Egerton projects growth of 5-10% in 2019 based on a new software offering. This will continue a growth in e-commerce that the company experienced in 2018. The company will look to add technical services staff by January 1st to help facilitate that expected growth. “More and more use of e-commerce order fulfillment centers will continue to drive demand,” says Egerton. He notes that customers more and more are looking for a complete solution, requiring the company to offer more than it previously had.

David Rizzo, President of AJ Jersey, Inc., projects that forklift sales will be relatively level in 2019, racking sales will increase by 20% coming off of a down year in 2018, and service will grow by 5 to 10% next year. “The first three quarters were sluggish for us this year,” he says. “But the last quarter has picked up dramatically and that should continue into 2019.” That increased activity started in September and has continued on throughout the year. “The new Governor in New Jersey can do significant damage to the growth of New Jersey businesses with his taxation and increased burden on New Jersey companies to fund his agenda,” says Rizzo. “That’s adding to the fuel taxes that are already the highest in the nation.” He also says that if the tariffs with China remain in place, it could have huge impact on sales in the United States.

Liftech Equipment Companies CFO and 2019 MHEDA Chairman of the Board Michael Vaughan projects a 3% growth for 2019, mostly driven by an increase in forecasted service revenue. He projects unit sales to be flat with an uptick in aftermarket. This is consistent with expectations for the industry as a whole, which Vaughan anticipates sustaining 2018 levels. “Legislation involving tariffs is having an impact in cost,” he says. “With no unexpected changes in Washington, the economy should continue at its current levels.” A new customer trend that Vaughan has seen emerge is the expectation of longer pay terms. “We try to negotiate some kind of reasonable alternative, including down payments on equipment purchases,” he says.

Equipment and parts sales will be the primary engine driving Hilo Equipment & Services to an anticipated 8-10% growth in 2019, according to President Steven LoPiccolo. The company entered into a new market in 2018 and LoPiccolo anticipates continued growth in that market in the 15-20% range. Hilo has been adding staff throughout 2018, a trend that will continue to meet demand, primarily service technicians and sales and administrative staff. He says that customers are now placing more of an emphasis on fleet management and guaranteed maintenance in an effort to manage materials handling costs. Hilo has acquired two companies in the last five years and LoPiccolo does not anticipate that the trend toward consolidation will stop anytime soon.

Bode Equipment Company President Scott Fawcett is projecting 5% growth for the company in 2019. “We have two salesmen entering their third year, one additional salesman entering his second year and three new lines in automation,” says Fawcett. Those are the primary reasons Bode is projecting growth in 2019. “On one hand, we are concerned because we had two large projects this year that won’t be there next year,” he says. “On the other hand, we are excited because our newer outside salesmen are positioned and excited for the new year with a number of new client opportunities. In combination with our new sales personnel, we have added three new supplier lines to take us into new markets and larger projects.” He adds, “I think the cost of a dollar and the impact of what that dollar can purchase will have a major impact on ROI evaluations. There is always a fear of inflation and we have been watching it rise. When it comes to larger projects, we are anticipating this as a critical impact factor to 2019.”

Southeast

In previous years, the Southeast was always the most optimistic region in the country. However, in 2018, expected growth was a little bit more reserved at 5.7%. This year it has returned to its more robust expectations, projecting an 8.92% growth in 2019.

“Lithium ion batteries may be a game changer,” says Jefferds Corporation President Richard Sinclair. He anticipates 5-6% growth in 2019. “Some of that is tariff driven price increases and some will be the latent affects of the 2017 tax package,” he says. Sinclair predicts that the industry as a whole will be up modestly. For Jefferds, Sinclair hopes to acquire some new geography in early 2019, as part of continuing consolidation. “We have benefited from some new lines that have come our way,” he says. He adds, “I think we will see modest inflation next year. We just have to deal with it but we will be religious about inventory, receivables and warranty claim collections.”

Gregory Poole Lift Systems Group Vice President Hal Ingram forecasts 3% growth in 2019 driven by customer acquisition and price increases. “We’re hearing from economists that a downturn is more likely in 2020 now. We’re predicting very modest growth in 2019,” he says. Ingram says that coming off of a record 2018 for the industry, he expects a flat to slightly down year in 2019 for material handling. In regards to the trend toward consolidation, Ingram says, “I see a continued trend toward larger dealers. Many smaller dealers do not have a solid succession plan. Investors outside our industry do not see the return percentages to get into our capital intensive business, therefore the large dealers will continue to absorb more of the opportunity.” In 2019 he’ll be monitoring what is happening with tariffs, product availability with the current high levels of consumption and what affect, if any, the 2018 election results bring.

Mid Middleton, President of Carolina Material Handling, is forecasting a 10% growth in 2019 for the dealership. The primary drivers of that growth are military and construction spending. He anticipates that Carolina Material Handling will add estimators and installers to the company in 2019. “Industry diversity is insurance against recession,” he says. He says that the trend toward consolidation has created more opportunity for the “little man” in storage and handling. He adds, “Inflation is good. We still will make our margins.”

MHEDA Board Member Ted Springer is the President of both Springer Equipment Company and Southfork Lift Truck. He expects strong years for both companies in 2019, with Springer projected to grow 5% and the newer Southfork Lift Truck projected for 20% growth. Part of that will be the natural progression, as Southfork is entering its 5th year in business. But the expansion of the aluminum industry will be beneficial as well. Springer will be aggressively adding technicians in 2019, expecting to grow the technician base by 10% in Alabama at Springer Equipment and 20% in Tennessee. He has seen customers expectations shift in the past few years and has had to adapt to those. “Their needs are similar as in the past but their timelines are now much shorter! We are working more with e-commerce and social media to meet the changing needs,” says Springer. He also predicts that the trend toward consolidation is here to stay, saying, “The industry will eventually be controlled by mega-dealers who cover larger geographic areas with large number of employees. The industry will eventually see large price increases for equipment and services to support the cost of mega-dealers.”

Advanced Equipment Company President Darin Boik projects a decline of 8% in sales in 2019. “We are short outside sales reps and 2018 was a very positive year that will be difficult for us to duplicate without filling those positions,” he says. He mentions that tariffs are taking their toll and that rising manufacturing costs will cause some companies to pass on some improvements. The company will look to add two new outside sales people, with the first coming in the first quarter of 2019.

Midwest

Last year, for the first time in many years, the Midwest ranked as the least optimistic region in the country, expecting only 5.13% growth. While they are not the least optimistic region this year, growth expectations are again tempered, with only an anticipated growth of 3.7% for 2019.

Meyer Material Handling Products Inc. is anticipating a level 2019 compared to 2018, according to President Greg Meyer. This tracks with an anticipated flat year for the industry by Meyer’s estimation. The company will look to add a sales representative in the first quarter of the year. Additional staff and the development of existing staff rank as the most important investment Meyer will be making in 2019.

Conveyer & Caster – Equipment for Industry Vice President of Engineering Rick Andrews projects a 5% growth in 2019, driven primarily by a new product line. CC-EFI will add staff in 2019 in the form of a customer service rep as well as a service technician. The company added a product line in the 4th Quarter of 2018, which will bear fruit for the company going forward. CC-EFI will also move into a new, larger building in 2019. Andrews says that while he expects inflation to impact everybody, it should be minimal.

Jim Hammond, President of Valley Industrial Trucks, also projects a 5% increase for 2019 on the back of new territory and increased pricing. “I see the economy as being strong and think this will continue in our market in 2019,” he says. Valley will introduce a new Doosan product line of their cushion redesigned product in the first quarter of the year. The consolidation trend has provided opportunities for Valley. He says, “I see trends for large mega-dealers which will provide opportunities because of poor customer service.”

Jerry Weidmann, President of Wolter Group expects to see growth next year in line with a projected GDP growth of 3%. The Group, including Wisconsin Lift Truck and Illinois Material Handling, expects to add skilled labor to replace retiring employees. “Business continues to be strong,” says Weidmann. “There are several factors that will be a drag on growth including a shortage of skilled labor, tariffs and interest rates.” He expects the industry to continue to be strong through the third quarter of the year and then to moderate in the fourth. Says Weidmann, “Customers are increasingly looking for automation solutions to improve their efficiency and to assist in solving the labor shortages they are experiencing. We have expanded our service offerings in the automation segment.” Acquisitions have facilitated the growth of The Wolter Group, a trend Weidmann sees continuing for the foreseeable future.

Aftermarket opportunities will be the primary engine for an anticipated growth of 10% for Toyota Material Handling Ohio. Says VP/COO Dan Hegler, “We saw continued progress with our new line of industrial cleaning equipment this year and an addition of battery line in 2019 with service opportunities. If we can find technicians, we expect continued growth in service.” The most important investment Toyota Material Handling Ohio will make next year is in battery servicing equipment, both in the shop and mobile. He does not anticipate inflation will be a large issue in 2019 but does caution that interest rates could.

RMH Systems, Inc. will be up 8% according to COO Todd Maxwell. “Most of our customers have a labor shortage and it’s only getting worse,” says Maxwell. “Customers are forced to automate their production lines to eliminate the need for labor.” RMH will add additional engineering staff to focus on automation and robotics in the first quarter of 2019. The company is experiencing turnover due to retirements in its sales team but has been fortunate in attracting new salespeople. Says Maxwell, “We identified the push towards replacing labor with automation. We became a FANUC ASI (Authorized Systems Integrator) a couple of years ago.”

Jack Turek, Dealer Principal of Connell Co., forecasts 5-10% growth for next year. “By taking on the Doosan line we expect to have access to more of the market than we have had in the past,” Turek says. The company will be able to handle the growth with existing staff, but will look to add a marketing specialist in 2019. Connell will be making a concerted effort to be involved with social media in 2019.

Chuck Frank, President of AHS, LLC, expects to see a flat 2019 compared to 2018. AHS is coming off of a very strong year and AHS hopes to replicate those strong results in 2019. “Robotics is changing the e-commerce landscape and will impact the traditional storage and conveyance solutions for Direct to Consumer fulfillment centers,” says Frank. AHS will look to add two customer facing sales team members in 2019 as well as additional mechanical and industrial engineers.

Riekes Equipment also anticipates a flat year in 2019, says President Duncan Murphy. Murphy anticipates a slowdown in the general economy. The political environment and tariffs are impacting things. Agriculture prices have been impacted which hits many related industries. Riekes will continue to implement a new computer system with added Mobile Field Service and CRM next year. He adds, “Companies continue to insulate themselves from anyone other than invited contacts. We are constantly working to establish our credentials so we can gain access.”

Elite Supply Chain Solutions President Scott Hennie forecasts 10-15% growth in 2019 based on automation, order fulfillment and collaborative marketing. The company plans to add staff in 2019 in engineering and project management. Hennie forecasts flat to moderate growth for the industry as a whole next year. He has seen a lack of available talent contributing to customer needs for automation in recent years, which Elite Supply Chain Solutions is able to provide.

Southwest

The Southwest continues its strong string of aggressive growth projections in 2019. It anticipates a whopping 13% growth in 2019, after projections of 7.36% in 2018, 5.86% in 2017 and 6% in 2016.

Greg Brown, President of W.W. Cannon, sees 10% growth on the horizon for 2019. The primary drivers of that will be e-commerce, an expanded sales force, service department and installation department, and additional service offerings. Even with a 10% growth projection, he says, “Consumer confidence being at an all time high will probably decrease. Small Business optimism index at an all time high will probably decrease. Overall I expect 2019 to be softer.” He has found that customers are looking for expanded services like pallet rack inspections, pallet rack repair and repair of other items. He says that inflation will lead to rising prices. “Communication is key to rising prices,” says Brown. “Letting customers know.”

Nelson Equipment anticipates 18% growth in 2019 according to President Mark Nelson. “2018 was a down year for us,” says Nelson. “We attribute that to competition and internal restricting more than economic reasons.” Nelson is actively looking to hire additional personnel. He has seen customers become more informed in recent years. “Customers are doing ALL their research and homework on the Internet of Things,” says Nelson. “We are having to be more informed about the customer needs even before we meet.” Inflation has already become an issue for the company, as the cost of steel and aluminum have increased.

Cisco-Eagle, Inc. President Darein Gandall expects 10-12% growth in 2019, driven field services and smaller projects. “We’re already seeing a reduction in capital expenditure products out there,” he says. Because of that, he anticipates service work will be picking up. “The customer needs are changing every year due to what we call the ‘Amazon effect,’ in which we all expect what we need immediately. We have streamlined several processes that allow us to respond to our customer base quicker,” he says.

West

The Western Region of the U.S. has been a roller coaster the last several years. In 2018, the region projected 8.3% growth versus 2017 where it was 3.9%. This year, participants expect sales to be essentially flat at 0.83% growth, which is the lowest of the regions in the forecast.

Warehouse Solutions Director of Sales Monte Landy projects sales to be flat to slightly down on a per sales person basis in 2019, noting that pipeline reports for the start of the year are pacing behind previous years. “Any growth would be through expansion,” says Landy. This is in line with his projection of a flat to slightly down year for the entire industry in 2019. The company will look to add sales staff and project management in 2019. He says that the industry-wide trend toward consolidation has driven down margins and expects the trend and the negative consequences associated with it to continue.

Jeff Darling, VP of Operations at Washington Liftruck, projects 5% growth in 2019 compared to 2018. “We anticipate a declining market as 2019 progresses but we also picked up the JCB Construction line which will provide us with new growth opportunities,” he says. “Residential and commercial growth has slowed down from the boom we have seen in the last five years. Considering that with the addition of two other Amazon headquarter sites just announced on the East Coast will certainly take some of the wind out of our sails. In addition, the viaduct, a major north-south transportation route paralleling Interstate 5 in Seattle will be closed on January 11, 2019, and the tunnel replacing it will only have 65% of the capacity of the viaduct without downtown access. Vehicle congestion charges for driving in the city of Seattle are not far off.”

Watts Equipment CEO Shirley Perreira anticipates sales to be up in 2019 on the back of better information management and tracking systems. “Our new equipment sales this year were a bit flat,” she says. “But it drove us to improve our measurement systems.” The company has added multiple technicians in anticipation of the growth and has also ordered more rental equipment. “I think this year has been such a bang that companies are starting to see things slow down for safety reasons,” says Perreira.

Western Storage and Handling, Inc. President Harry Neumann, Jr. predicts sales to decrease by 10% in 2019. The company has sales staff retiring in 2019 that will impact sales and will look to add sales staff to replace the production next year. Neumann projects the industry as a whole to be up about 5%. Western is involved with social media and has seen real tangible results from that participation. “We have had inquiries on products that have been the subject of posts on social media and on blogs which are posted on our website,” he says. Neumann does not anticipate inflation being an issue next year.

EKKO Material Handling Equipment, Mfg. will see a sales increase due to the rapid growth it has already experienced and due to providing additional classes for 2019. This, according to Director Don Hwang. “Dealers are starting to recognize the EKKO name for quality equipment with higher margins that dealers really deserve to make again,” he says. The company will add additional staff to help with this growth projection. “We will be offering stand up reach trucks and order pickers due to arrive by the end of the second quarter.”

John Faulkner, President of FMH Material Handling Solutions, projects 3% growth for 2019 based on population increases in the Rockies and expansion. The tax benefits were a positive indicator in 2018 that Faulkner believes will carry through. FMH will add sales staff in 2019. The company will also invest in an increased rental fleet, which will be the most important investment it makes in Faulkner’s estimation. Of the potential impact of inflation, Faulkner says, “No question. We see price increases in all segments.”